Safeguarding accounts – hard to source, costly and little to no upside.

A safeguarding account can be difficult to source and costly, or some companies face the ‘chicken and egg’ scenario, where a safeguarding account is only issued once a level of commercial viability has been achieved.

Banks that issue safeguarding accounts pay little interest—or none—even as rates have shifted to the highest levels in over X years (find the data). Safeguarding funds are idle, not generating any revenue, while EMIs pay monthly fees for the safeguarding account.

Safeguarding accounts – hard to source, costly and little to no upside.

Banks that issue safeguarding accounts pay little interest—or none—even as rates have shifted to the highest levels in over X years (find the data). Safeguarding funds are idle, not generating any revenue, while EMIs pay monthly fees for the safeguarding account.

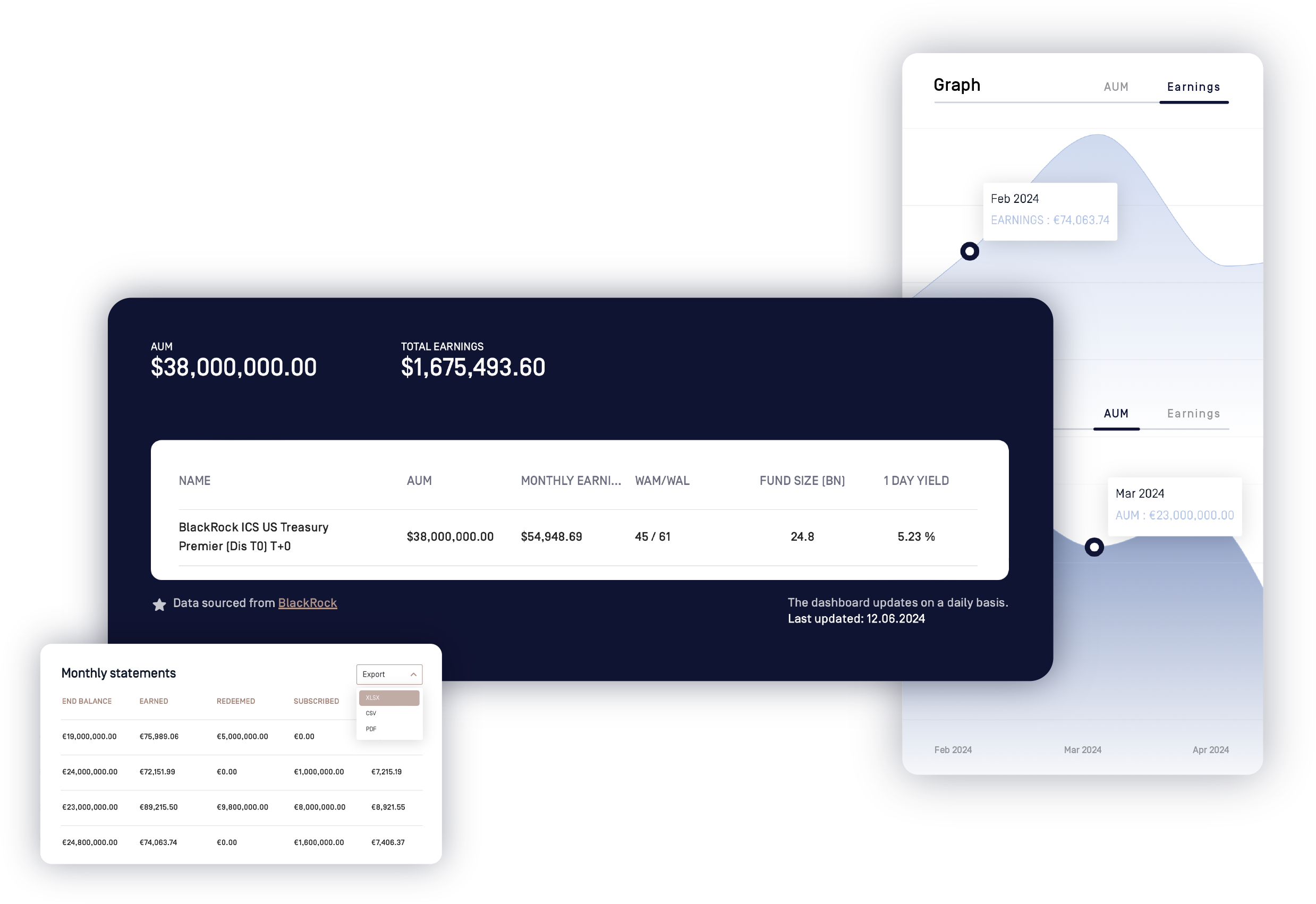

Safeguard funds and generate revenue from idle cash.

There is €35B in safeguarded funds in Europe and the UK. The potential opportunity for EMIs to safeguard their assets in liquid, transparent and yielding money market funds, sits at €1.75B.

Key features of our platform